🗓️ May Updates

Keeping HR pros up to date with important compliance updates and human resource articles.

Proposed Change to Affordability for Family Coverage

On April 5, 2022, the IRS issued a proposed rule that would change existing rules for premium tax credit (PTC) eligibility. The PTC is available to eligible individuals who purchase health coverage through the Exchange. Individuals who have access to affordable, minimum value employer coverage are not eligible for the PTC.

Currently, the affordability of employer coverage for family members is determined based on the lowest-cost self-only coverage available to the employee. The cost of family coverage is not taken into account. These rules apply for determining eligibility for the PTC and for purposes of the employer shared responsibility rules. The proposed rule would provide that an employer-sponsored plan is affordable for family members if the portion of the premium the employee must pay for family coverage does not exceed 9.5% (as adjusted) of their household income. Family coverage includes all employer plans that cover any individuals related to an employee. The proposal would also add a minimum value rule for family members.

If this rule is finalized, the change would likely mean more individuals will be newly eligible for the PTC for coverage purchased through the Exchange. The proposal would not affect affordability for employees. Thus, an employee’s family member may have an offer of unaffordable employer coverage, even if the employee has an affordable offer of self-only coverage.

IRS Proposes Change to Family Coverage Affordability Rules 4-13-22.pdf

New HSA/HDHP Limits for 2023

The IRS announced recently that Health Savings Account (HSA) contribution limits for 2023 are going up significantly in response to the recent inflation surge, giving employers that sponsor high-deductible health plans (HDHPs) plenty of time to prepare for open enrollment later this year.

The annual-inflation adjusted limit on HSA contributions for self-only coverage will be $3,850, up from $3,650 in 2022. The HSA contribution limit for family coverage will be $7,750, up from $7,300. Here are some helpful HSA contribution reminders:

- Married couples with HSA-eligible family coverage will share one family HSA contribution limit of $7,750 in 2023. If both spouses have eligible self-only coverage, each spouse may contribute up to $3,850 in separate accounts.

- If both spouses with family coverage are age 55 or older, they must have two HSA accounts in separate names if they each want to contribute an additional $1,000 catch-up contribution.

- If only one spouse is 55 or older but the younger spouse contributes the full family contribution limit to the HSA in his or her name, the older spouse must open a separate account to make the additional $1,000 catch-up contribution.

- Account holders who exceed the contribution limit are subject to an annual 6% excise penalty tax on the excess amount unless it is withdrawn from the HSA before the tax deadline for that year.

HSA Limits for 2023.pdf

DOJ Issues Guidance on Opioid Addiction & the ADA

On April 5, 2022, the U.S. Dept. of Justice (DOJ) issued guidance on how the ADA can protect individuals with opioid use disorder (OUD) and other addictions from discrimination. The DOJ’s guidance explains that individuals with OUD typically qualify for ADA protection because drug addiction is a physical or mental impairment that often substantially limits one or more major life activities. Individuals in recovery from drug addiction may also qualify for ADA protection if they would be limited in a major life activity without treatment or services to support recovery.

The ADA’s protections do not apply if an individual is engaged in the “current illegal use of drugs.” This is generally defined as illegal use occurring recently enough to justify a reasonable belief that this use is current or that continue use is a real and ongoing problem. The definition does not include the use of a prescribed medication under the supervision of a licensed healthcare professional.

The DOJ guidance clarifies that employers may implement reasonable policies or procedures, including drug testing, designed to ensure individuals are not engaging in current illegal drug use.

Transparency in Coverage – Machine-readable Files Required on Public Websites by July 1, 2022

As the initial enforcement date approaches for posting machine-readable files (MRF) under the Transparency in Coverage Rule, the following are some reminders of requirements for health insurers and group health plans, including self-funded clients:

- The government requirement applies to plan years beginning on or after Jan. 1, 2022, with an enforcement date of July 1, 2022.

- Insurers and self-funded plans must publicly post the files by July 1, 2022, which include detailed pricing data for all covered items and services via 3 MRF’s. It’s important to note that the third file is delayed pending additional guidance and is not required at this time.The 3 MRF’s include:

- In-network negotiated payment rates

- Historical out-of-network allowed amounts

- In-network rates and historical costs for prescription drugs (delayed pending guidance)

- Date in these files must be in the JSON file format and must be updated monthly. Posting Excel documents, PDF’s or other non-MRF’s are not permitted.

Under the Transparency in Coverage Rule, health insurers and group health plans, including self-funded groups, must create an online tool that provides members with personalized, real-time, cost-share estimates for all covered services and items, including prescription drugs, with paper versions available upon request. This requirement is effective for plan year beginning on and after Jan. 1, 2023, for 500 designated services, and for plan years beginning on or after Jan. 1, 2024, for all services.

Plans should confirm that their TPA’s are providing the required notice and have created a “public website” for the Plan. The government has provided the following model notice for further guidance.

Model Disclosure Notice Regarding Patient Protections Against Surprise Billing.pdf

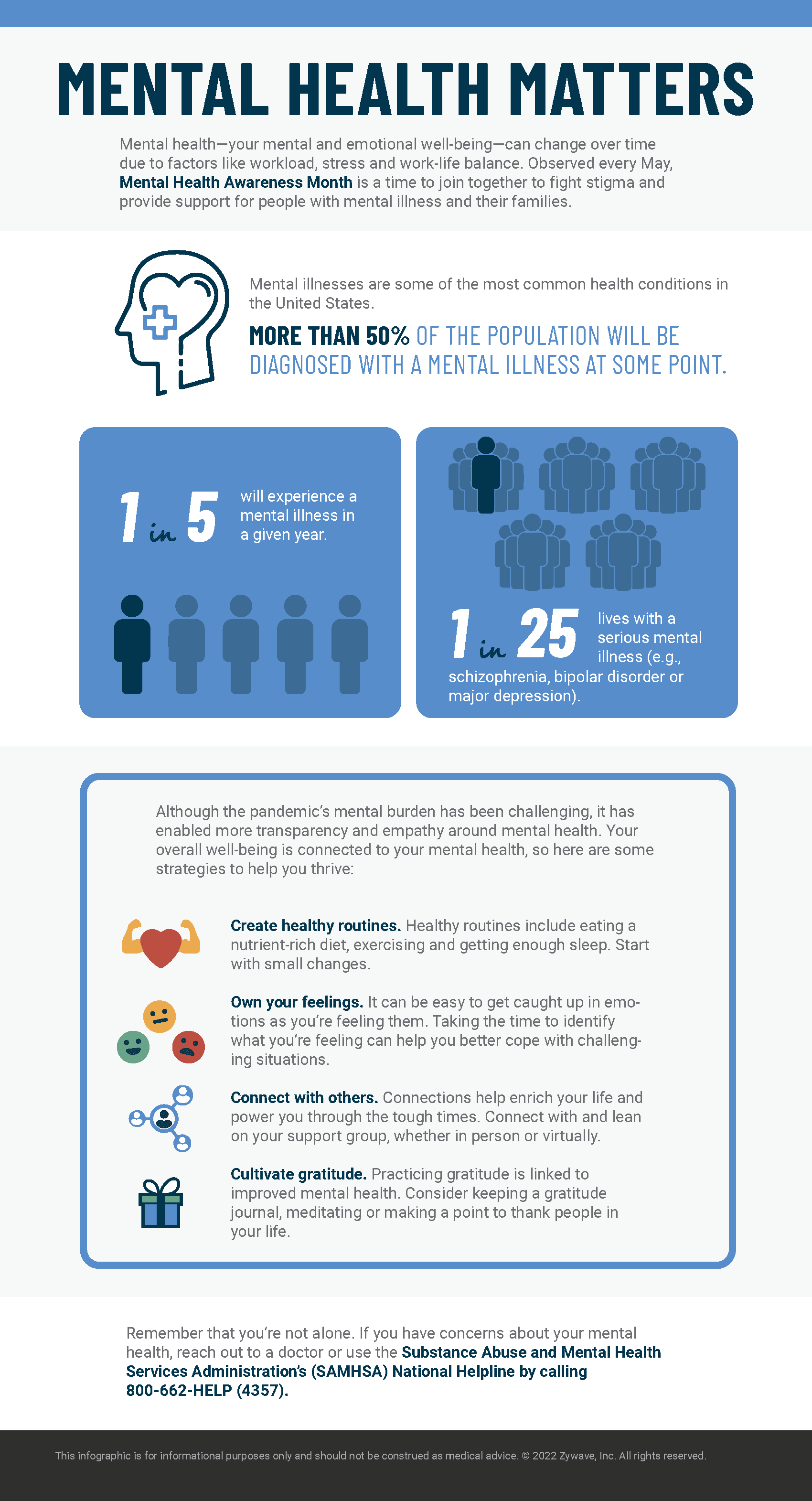

Take Care of Yourself – May is Mental Health Awareness Month

Now is a good time to pause and reflect. May is Mental Health Awareness Month, so we want to make sure we recognize a difficult truth – nearly one in five Americans lives with a mental health condition, according to the National Institute of Mental Health. Half of mental illnesses begin by age 14, and most go untreated. When mental illness goes untreated, it can impact overall health, well into adulthood. It’s important to remember that we are never alone. Experts stress that now is the time to focus on healing, reaching out, and connecting in safe ways by acknowledging that it’s okay to not be okay.

If there is someone in your life struggling with their mental health, the best thing you can do is reach out and start a conversation. Educate yourself on the realities of living with mental health issues and confront any feeling of stigma or judgment you may have. Just supporting those in your life can spread the message of awareness and acceptance.

Supporting the mental health of our employees is more important than ever. Providing your workforce and their families with an Employee Assistance Program (EAP) is a valuable benefit. Often, disability carriers will have EAP services embedded within their policies. Organizations may also want to consider partnering with an organization to provide a stand-alone EAP. Your Nulty team is available to help you explore EAP options, so please let us know if we can be of assistance.