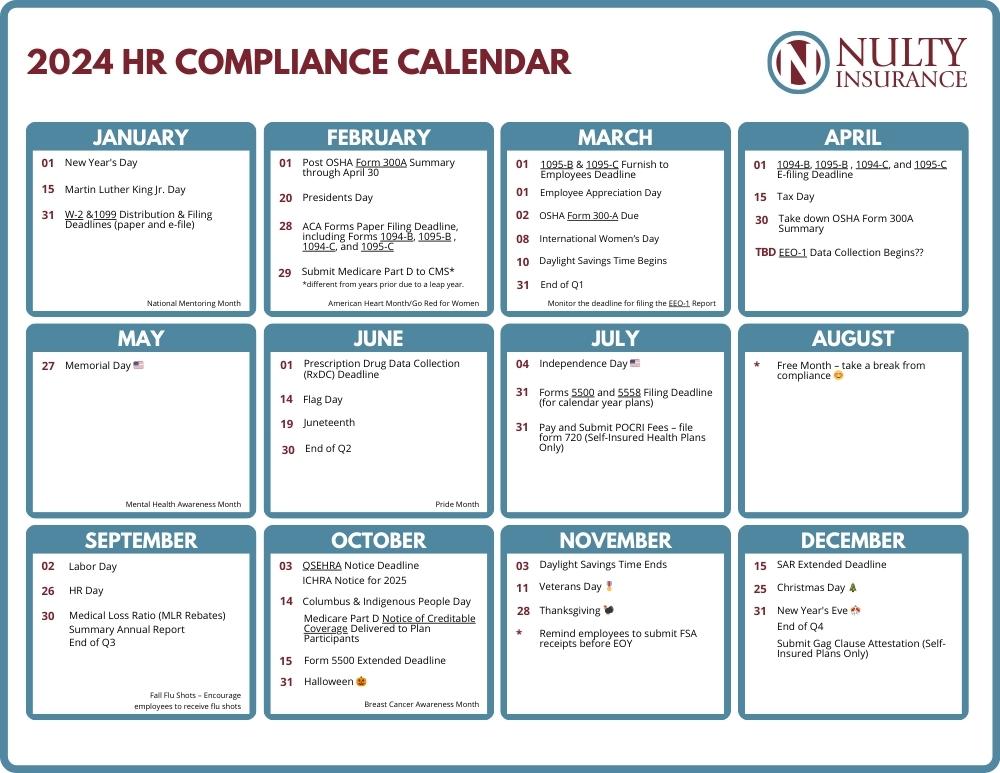

HR must juggle ever-changing employment, payroll, and benefits compliance requirements. We’ve put together this HR Compliance Calendar, so you can tackle HR compliance with ease. From major holidays to key compliance and ACA deadlines, find out everything you need to know about important HR dates for 2024.

2024 HR Calendar Key Dates and Holidays

*Dates may be subject to change and will be updated accordingly.

🗓️ JANUARY

- January 1 – New Year’s Day

- January 15 – Martin Luther King Jr. Day

- January 31 – Forms W-2 & 1099 Distribution & Filing Deadlines (paper and e-file)

- National Mentoring Month – The National Mentoring Partnership

🗓️ FEBRUARY

- February 1 – Post OSHA Form 300A Summary through April 30

- February 20 – President’s Day

- February 28 – ACA Forms Paper Filing Deadline, including Forms 1094-B, 1095-B , 1094-C, and 1095-C

- February 29 – Submit Medicare Part D to CMS*

*different from years prior due to a leap year - National Wear Red Day® and American Heart Month / Go Red for Women

🗓️ MARCH

🗓️ APRIL

🗓️ MAY

- May 27 – Memorial Day

- Mental Health Awareness Month

🗓️ JUNE

- June 1 – Prescription Drug Data Collection (RxDC) Deadline

- June 14 – Flag Day

- June 19 – Juneteenth

- June 30 – End of Q2

- Pride Month

🗓️ JULY

🗓️ AUGUST

- Free Month – take a break from compliance 😊

🗓️ SEPTEMBER

- September 2 – Labor Day

- September 26 – HR Day

- September 30 – Medical Loss Ratio (MLR Rebates)

- September 30 – Summary Annual Report

- September 30 – End of Q3

🗓️ OCTOBER

- October 3 – QSEHRA Notice Deadline

- October 3 – ICHRA Notice for 2025

- October 14 – Columbus Day & Indigenous People Day

- October 14 – Medicare Part D Notice of Creditable Coverage Delivered to Plan Participants

- October 15 – Form 5500 Extended Deadline

- October 31 – Halloween 🎃

- Breast Cancer Awareness Month

🗓️ NOVEMBER

- November 3 – Daylight Savings Time Ends

- November 11 – Veterans Day 🎖️

- November 28 – Thanksgiving 🦃

- Remind employees to submit FSA receipts before EOY

🗓️ DECEMBER

- December 15 – SAR Extended Deadline

- December 25 – Christmas Day 🎄

- December 31 – Submit Gag Clause Attestation (Self-Insured Plans Only)

- December 31 – New Year’s Eve 🎊

- December 31 – End of Q4

Forms – Links, Descriptions & Deadlines

Click to expand

1095-B and 1094-B

Form 1095-B is used to meet the Section 6055 reporting requirement to confirm minimum essential coverage. Form 1095-B is used by insurers, plan sponsors of self-funded multiemployer plans, and plan sponsors of self-funded plans that have fewer than 50 employees to report on coverage in effect for the employee, union member, retiree, or COBRA participant, and their covered dependents, on a month-by-month basis.

Filers use Form 1094-B as the transmittal to submit the Form 1095-B return.

Timing

1095-B to IRS: February 28 for paper filers, or March 31 for electronic filers.

1095-B to employees: January 31 (IRS proposed regs with 30-day automatic extension)

1095-C and 1094-C

Form 1095-C is used to meet the ACA Section 6056 reporting requirement for Applicable Large Employers (employer shared responsibility/play-or-pay) and to determine whether an individual is eligible for a premium tax credit. Form 1095-C is also distributed to employees to verify coverage offering during the year.

Filers use Form 1094-C as the transmittal to submit the 1095-C return to the IRS.

Timing

1095-C to IRS: February 28 for paper filers, or March 31 for electronic filers.

1095-C to employees: January 31 (IRS proposed regs with 30-day automatic extension)

5500

Form 5500 is the annual filing to DOL and IRS that plans with 100 participants or more use to report required information about the plan’s financial condition. Form 5500-SF can be filed for eligible plans with less than 100 participants. Form 5500-EZ can be filed for one-participant retirement plans or foreign plans. See the IRS Form 5500 Corner for information.

Timing

Due on the last day of the seventh month after the plan year end.

5558

Employers may obtain an automatic extension to file Form 5500, Form 5500-SF, Form 5500-EZ, Form 8955-SSA, or Form 5330 by filing IRS Form 5558. The extension will allow return/reports to be filed up to the 15th day of the third month after the normal due date.

Timing

Due on or before the date the return/reports must be filed.

7004

Employers use IRS Form 7004 to receive an automatic 6-month extension to file Form 8928 and other general business returns.

Timing

Generally, must be filed on or before the due date of the applicable tax return.

8809

Employers use IRS Form 8809 to get an automatic 30-day extension of time to file Forms 1094-B or 1094-C.

Timing

Must be filed on or before the due date of the returns.

8928

Employers and plan administrators should self-report any failure to comply with various group health plan requirements, including requirements related to the ACA, COBRA, HIPAA, Mental Health Parity, and the comparable contribution requirement for health savings accounts (HSAs), using IRS Form 8928.

Timing

Deadline to submit form and pay excise tax is plan sponsor’s federal income tax return filing deadline.

For MEWA, deadline is the last day of the seventh month following the close of the plan year.

Deadline for violating HSA comparable contributions requirements is April 15 following the calendar year in which the non-comparable contributions were made.

M-1

Multiple employer welfare arrangements (MEWAs) and Entities Claiming Exception (ECEs) are required to file Form M-1 with DOL to report required information about the MEWA’s custodial and financial condition (subject to certain exceptions).

Timing

Due by March 1 of the year following the calendar year for which reporting is required. An automatic 60-day extension is available if filed by the normal due date for Form M-1.

W-2

Employers must report the aggregate value of applicable employer-sponsored health coverage on Form W-2 for the prior calendar year. See the IRS page Form W-2 Reporting of Employer-Sponsored Health Coverage for information.

Timing

The deadline to file and furnish Form W-2 is January 31.

ICHRA – Individual Coverage Health Reimbursement Arrangement Notice

Employers that provide an ICHRA must furnish written notice to each participant containing specific information about the ICHRA. See the DOL model notice for information.

Timing

Notice must be provided at least 90 days before the start of the plan year.

For newly eligible employees, written notice must be provided no later than the date coverage may begin.

Medical Loss Ratio (MLR Rebates)

Issuers must spend a minimum percentage of their premium dollars, or MLR, on medical care and healthcare quality improvement. Issuers that do not meet the applicable MLR must pay rebates to consumers.

Sponsors of insured health plans may receive rebates if their issuers did not meet their MLR. Employers that receive rebates should consider their legal options for using the rebate. Any rebate amount that qualifies as a plan asset under ERISA must be used for the exclusive benefit of the plan’s participants and beneficiaries.

Timing

Rebates must be provided to plan sponsors by Sept. 30, following the end of the MLR reporting year.

Also, as a general rule, plan sponsors should use the rebate within three months of receiving it to avoid ERISA’s trust requirements. Plan sponsors that receive a rebate prior to Sept. 30 may need to adjust their deadline to use the rebate.

Medicare Part D Creditable Coverage Disclosure to CMS

Employers with group health plans that provide prescription drug coverage to individuals that are eligible for Medicare Part D must disclose to CMS whether the coverage is creditable prescription drug coverage. Employers must provide CMS with this information via the Disclosure to CMS Form completed and sent electronically through the CMS website.

See the CMS instruction guide with screenshots for completing the form online.

Timing

Form must be provided annually, within 60 days after the first day of the plan year for the reporting year. Also, within 30 days after the prescription drug plan’s termination or within 30 days after any change in the creditable coverage status of the prescription drug plan.

Medicare Part D Notice of Creditable Coverage to Plan Participants

The Medicare Modernization Act penalizes individuals for late enrollment in Medicare Part D if they do not maintain “creditable coverage” for a period of 63 days or longer following their initial enrollment period for drug benefits. Plan sponsors must disclose whether prescription drug coverage is creditable or non-creditable. CMS provides model notices for creditable coverage and non-creditable coverage disclosures in both English and Spanish.

Timing

Disclosures to individuals must be made:

- Prior to the Medicare Part D annual coordinated election period – October 15 through December 7 of each year

- Prior to an individual’s initial enrollment period for Medicare Part D

- Prior to the effective date of coverage for any Medicare-eligible individual that joins the plan

- Whenever prescription drug coverage ends or coverage changes so that it is no longer creditable or becomes creditable

- Upon request by a beneficiary

If the creditable coverage disclosure notice is provided to all plan participants annually, prior to October 15 of each year, CMS will consider items 1 and 2 above to be met.

QSEHRA – Qualified Small Employer Health Reimbursement Arrangement Notice

Employers that provide a QSEHRA must furnish written notice to eligible employees including a statement of the amount of each permitted benefit for which the employee might be eligible, a statement that the eligible employee must provide the amount of the permitted benefit to the marketplace if the employee applies for an advance premium tax credit, and a statement that the employee may be liable for any month in which they do not have minimum essential coverage.

Timing

Written notice to eligible employees at least 90 days before the beginning of each plan year.

For mid-year eligible employees, notice must be sent the date the employee becomes eligible.

Summary Annual Report (SAR)

Employers that are required to file a Form 5500 must provide participants with a summary of the information in Form 5500, called a summary annual report (SAR). Plans that are exempt from the annual 5500 filing requirement are not required to provide a SAR. Large, completely unfunded health plans are also generally exempt from the SAR requirement.

Timing

The plan administrator generally must provide the SAR within nine months of the close of the plan year. For calendar-year plans, this deadline is Sept. 30, 2023.

If an extension of time to file Form 5500 is obtained, the plan administrator must furnish the SAR within two months after the close of the extension period.