🗓️ March 2024

Keeping HR pros updated with important compliance, benefits, and human resources information.

Wrap Documents for Welfare Benefit Plans

ERISA requires welfare benefit plans, such as group health plans, to have a plan document and an SPD. In most cases, the certificate or booklet provided by an insurance carrier (or other third party) does not satisfy ERISA’s requirements for plan documents and SPDs. This Compliance Overview explains how employers may use wrap documents in conjunction with the insurance certificate or booklet in order to satisfy ERISA’s plan document and SPD requirements.

Johnson & Johnson Class Action Lawsuit

In February, Johnson & Johnson (JNJ) faced a federal class action lawsuit over alleged overpayment for prescription drugs within its plan. The lawsuit, citing ERISA obligations, accuses JNJ’s fiduciaries of imprudence in agreeing to terms with a pharmacy benefit manager (PBM) resulting in excessive costs. This underscores the importance of transparency in drug pricing comparisons and highlights risks for health plan fiduciaries.

Employers should take proactive steps to mitigate risks:

- Establish a dedicated fiduciary committee for health and welfare benefits

- Engage impartial consultants to assess PBMs and drug arrangements

- Review and negotiate PBM agreements to ensure reasonability

- Gather benchmark data to evaluate vendor agreements

- Scrutinize compensation arrangements for conflicts of interest

- Periodically solicit proposals from PBMs to reassess competitiveness

- Document all decisions to demonstrate procedural prudence and compliance

These steps help navigate evolving fiduciary responsibilities and protect plan participants’ interests. Watch the video below to learn more about the roles and responsibilities of fiduciaries and the Johnson and Johnson lawsuit.

DOL Releases Benefit-related Penalty Amounts for 2024

On Jan. 11, 2024, the U.S. Department of Labor (DOL) published the 2024 inflation-adjusted civil monetary penalties that may be assessed for a wide range of employee benefit-related violations.

Background

To advance the effectiveness of civil money penalties and strengthen their deterrent effect, federal law requires agencies across the federal government to adjust their penalties for inflation no later than Jan. 15 of each year. Last year, the DOL’s final rule on 2023 inflation-adjusted amounts was published on Jan. 13, 2023.

Violations concerning the following have penalty increases that may affect employers and employee benefit plan administrators:

- Summary of Benefits and Coverage (SBC)

- Form 5500 filings

- Multiple Employer Welfare Arrangement (MEWA) filings

- Children’s Health Insurance Program (CHIP) notice

- 401(k) disclosures

- Failure to furnish DOL-requested plan information

Action Steps

Employers should become familiar with the new penalty amounts and review their benefit plan administration protocols to ensure full compliance. Please contact us at compliance@nulty.com for assistance!

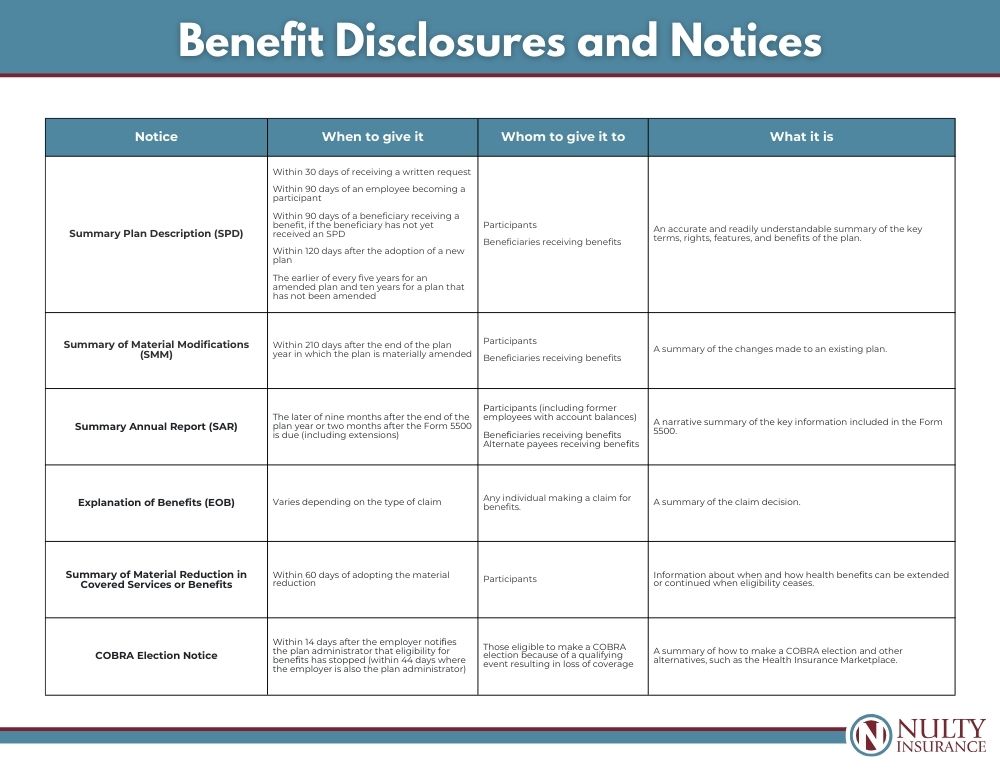

Benefit Disclosures and Notices: An easy reference

Notifying participants and beneficiaries about your employee benefits is an important part of compliance and getting the most out of your benefits by ensuring employees know what their options are. The chart below outlines what disclosures and notices are required, who needs to receive them, and when to send them out.

Please Note

It does not include documents that are filed with governmental entities, such as Form 5500 or documents and notices that are rarely distributed (such as the plan document) or have very complicated requirements (such as domestic relations orders). Many of these disclosures and notices are prepared or sent out (or both) by your service providers.

Pregnant Workers Fairness Act – HR Toolkit

The PWFA is a federal law that requires private employers with 15 or more employees and other covered entities to provide reasonable accommodation for the known limitations of a qualified individual related to pregnancy, childbirth, or related conditions unless it would cause undue hardship. This HR Toolkit provides an overview for employers on handling requests for accommodation for limitations related to pregnancy, childbirth and related medical conditions under the Pregnant Workers Fairness Act (PWFA).

Question of the Month

Q. What are the time and dollar limits for flexible spending arrangements (FSA) and FSA carryovers?

A. For 2024, the most that can be deferred to an FSA is $3,200 (a $150 increase from 2023). The amount of a 2024 FSA balance that can be carried over into 2025 is $640 (up from $610 in 2023). A carryover is only available if the FSA does not offer a grace period. The carryover amount can be used all year.

A grace period, on the other hand, is the amount of time in a new year that an employee can incur and be reimbursed for claims from the prior year’s balance. A grace period can be as long as 2 ½ months after the close of the plan year (usually the calendar year). So, if an employee has $1,000 left in the 2023 FSA, that employee could incur $1,000 of reimbursable expense prior to March 15, 2024, and spend that $1,000 if the FSA uses a grace period. An FSA cannot have both a grace period and a carryover.

And finally, most FSAs offer a run-out period. This is a period after the close of the plan year when employees can submit claims incurred in the prior year. There is no maximum run-out period set by the IRS, but most employers (or FSA administrators) will set a limit of 60 to 90 days. The run-out period only allows people to submit claims incurred in the prior year, unlike the grace period, which allows new claims incurred prior to March 15 to be reimbursed.