🗓️ November 2023

Keeping HR pros up to date with important compliance, benefits, and human resources information.

Revised Form I-9 Now in Effect

Beginning November 1, 2023 employers completing the employment eligibility verification process must now utilize the revised Form I-9, dated 08/01/2023. All prior versions of Form I-9 will no longer be accepted, and use of a prior Form I-9 may subject employers to penalties.

Contact us at compliance@nulty.com if you need help with this and we will be happy to assist you with this or any other questions related to Form I-9 compliance.

H-1B Proposed Rule

U.S. Citizenship and Immigration Services (USCIS) published a Notice of Proposed Rulemaking (“proposed rule”) which would modernize the H-1B specialty occupation worker program, while also reducing misuse and fraud. Specifically, the proposed rule would allow an individual who has a registration submitted on their behalf only one entry into the selection process, even if multiple registrations are submitted on their behalf.

Among additional provisions, the proposed rule would improve the H-1B program by:

- Streamlining eligibility requirements

- Improving program efficiency

- Providing greater benefits and flexibilities for employers and workers

- Strengthening integrity measures

For more information, visit the full article found at the Department of Homeland Security website.

DOL Publishes FLSA Overtime Rule with Higher Salary Levels for White Collar Employees

On Aug. 30, 2023, the U.S. Department of Labor (DOL) announced a proposed rule to amend current requirements employees in white-collar occupations must satisfy to qualify for an overtime exemption under the Fair Labor Standards Act (FLSA).

The DOL is proposing to increase the standard salary level from:

• $684 to $1,059 per week ($55,068 per year); and

• $107,432 to $143,988 per year for highly compensated employees.

The DOL proposal also includes mechanisms that would allow the agency to automatically update the white-collar salary level thresholds automatically every three years without having to rely on the rulemaking process.

Impact on Employers

The proposal does not impose any new requirements on employers at this time. However, employers should become familiar with the proposed rule and evaluate what changes they may need to adopt if the rule is implemented as proposed.

Reviewing your exempt and hourly paid staff can be a daunting task. We can help you with a plan to implement these changes to the new salary threshold so that you are ready if and when this proposal is passed. Contact us at compliance@nulty.com.

ACA Reporting: Most Employers Must File Electronically in 2024

Currently, any reporting entity that is required to file at least 250 individual statements under Sections 6055 or 6056 must file taxes electronically. However, on Feb. 23, 2023, the IRS released a final rule implementing a change to the Taxpayer First Act of 2019. This law change lowers the 250-return threshold for mandatory electronic reporting to 10 returns. This means that beginning in 2024, reporting entities that file at least 10 individual statements will need to file electronically.

A Quick Reminder about Michigan’s Distracted Driver Law

Although this law went into effect several months ago now, just a reminder that if you have employees who are driving as part of their job, it is a good idea to review your policies and expectations for those employees to be sure that they are not expected to do things for their job that are outside of this law. Need help navigating? Let us know! Send us an email at compliance@nulty.com.

New Joint-Employer Standard

The National Labor Relations Board (NLRB) has introduced a new rule on joint-employer status, effective December 26, 2023. This rule changes the criteria for determining joint-employer relationships, making it easier for employers to be classified as joint employers. The rule emphasizes control over essential terms and conditions of employment, irrespective of whether such control is exercised. The 2023 rules replaces the 202- standard, providing a more inclusive definition and detailing the types of control relevant to joint-employer status.

Employer Action Steps:

- Awareness and Understanding: Employers, especially contractors and subcontractors, should familiarize themselves with the new rule to understand its implications.

Evaluate Joint-Employer Status: Employers should assess whether the new, more inclusive standard would reclassify them as joint employers. This evaluation should consider the level of control over essential terms and conditions of employment. - Precautionary Measures: Employers affected by the new standard should take precautionary steps to ensure compliance with labor and employment laws for joint employees. This includes reviewing and updating policies related to wages, benefits, hours of work, supervision, discipline, and other essential conditions of employment.

- Stay Informed on Rights and Responsibilities: Stay informed about the extensive guidance provided by the NLRB regarding rights and responsibilities in situations where joint-employers status has been established.

- Implementation of the New Rule: Implement necessary changes in policies and practices to align with the new rule’s requirements. This may involve adjusting the approach to essential terms and conditions of employment.

If you have compliance concerns with the New Joint-Employer standard, please contact us at compliance@nulty.com – our team can help ensure compliance with labor and employment regulations.

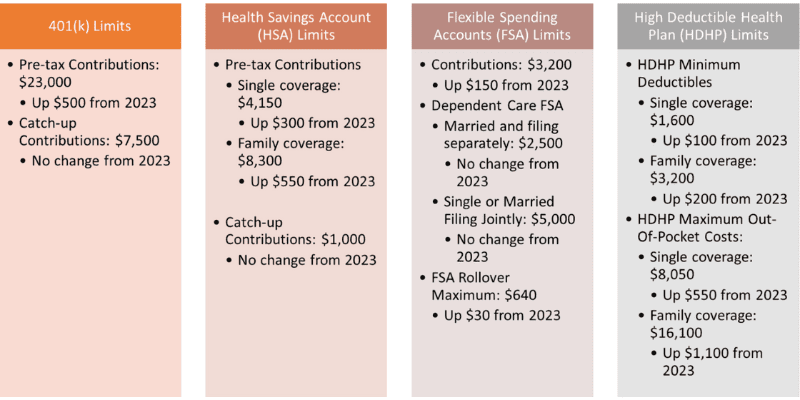

2024 Limits to Know

Many benefit plan limits have changed for the new calendar year – here are the key limits to know for 2024:

Implementation of Transparency in Coverage Regulations

The government departments, like the Department of Labor, Internal Revenue Service, and Health and Human Services, have given new guidance on rules about making healthcare costs clear. These rules, called “Transparency in Coverage (TiC) rules, say that health plans must share information about costs like what they pay for in-network services, out-of-network charges, and prescription drug prices. They need to do this by putting the information on a website or giving it on paper when asked. The government made these rules, and later, Congress added more rules in the Consolidated Appropriations Act, 2021 (CAA 2021).

Now, there are specific deadlines for following these rules:

- By July 1, 2022, health plans must share machine-readable files for in-network and out-of-network services.

- By January 1, 2023,

- They need to have a Price Comparison Tool.

- There should be a Cost Estimating Tool showing information on the 500 most common services.

- By January 1, 2024, the Cost Estimating Tool should have information on all common services.

- There is no fixed date for sharing machine-readable files for prescription drug pricing yet.

In September 2023, the government gave more information in a FAQ. They removed the delay in enforcing the rule about sharing prescription drug prices in a way machines can read. They also removed the safe harbor rule that let health plans avoid sharing in-network service rates when it’s hard to give a specific dollar amount. Now, health plans must follow existing technical reporting guidance for rates that aren’t in dollars. The government says they’ll decide when to enforce these rules on a case-by-case basis.

Adjusted Civil Penalties

The U.S. Department of Health and Human Services (HHS) has made changes to the fines for breaking certain health-related rules. These rules cover things like privacy and security in health information, as well as rules for health insurance and Medicare. The new fines are adjusted for inflation and apply to violations that happened on or after November 2, 2015, with penalties assessed on or after October 6, 2023.

For breaking the rules about health information privacy (HIPAA), the fines depend on the seriousness of the violation:

- If someone didn’t know they were breaking the rules, the fine can be at least $137, up to a maximum of $68,928, with a cap of $2,067,813 per year.

- If there was a good reason for breaking the rules but not on purpose, the fine can be at least $1,379, up to a maximum of $68,928, with the same yearly cap.

- If the violation was on purpose but fixed within 30 days, the fine can be at least $13,785, up to a maximum of $68,928, with the yearly cap.

- If the violation was on purpose and not fixed within 30 days, the fine can be at least $68,928, up to a maximum of $2,067.813, with the yearly cap staying the same.

There are also fines for providing certain information before someone enrolls in a health plan, and for not following rules about Medicare. As an employer, you will want to be diligent about these rules to avoid these fines.